Company case study

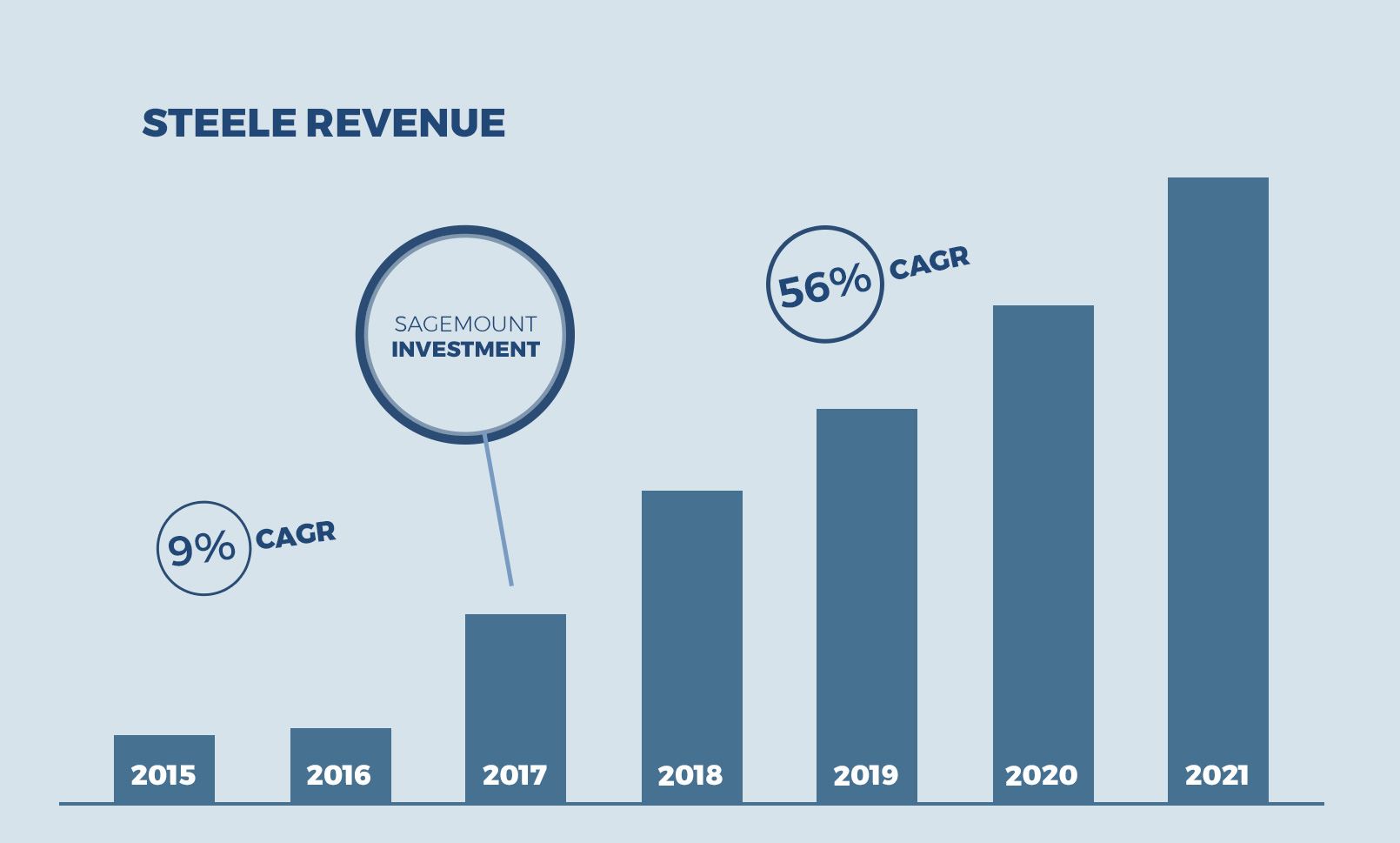

Sagemount’s contribution to M&A sourcing, underwriting, and execution, pricing and bundling optimization, and exit planning resulted in an outsized outcome for Steele.

-

Investment snapshot

Industry: Software

Year Invested: 2016

Year Exited: 2021

Outcome: Acquired by Diligent Corporation

Status: Exited -

Sagemount team

-

Company info

Steele Transaction Overview

- In May 2016, Sagemount acquired a controlling interest in Steele

- During Sagemount’s hold, Steele focused on organic growth initiatives including refining its pricing strategy and aggressively investing in its software and data products

- Sagemount partnered with Steele’s management to pursue strategic M&A, vetting over 25 opportunities and closing four acquisitions focused on product roadmap acceleration. The acquisitions helped Steele evolve from a third party risk management specialist to a Steele as a “full suite” GRC software provider.

- In March 2021, Diligent Corporation acquired Steele Compliance for an fully-valued strategic multiple of revenue and EBITDA